Financial Solutions for Small Businesses

Streamline your payments, invoicing, and banking operations with tools designed specifically for small businesses.

Get Started

Streamline your payments, invoicing, and banking operations with tools designed specifically for small businesses.

Get Started

We understand the unique financial challenges you face

Maintaining healthy cash flow while managing day-to-day expenses and unexpected costs.

Creating, sending, and tracking invoices while ensuring timely payments from customers.

Staying compliant with tax regulations and maintaining accurate financial records.

Tailored financial tools to help your business thrive

Process payments to vendors, contractors, and employees with ease. Schedule recurring payments and manage all your outgoing funds from a single dashboard.

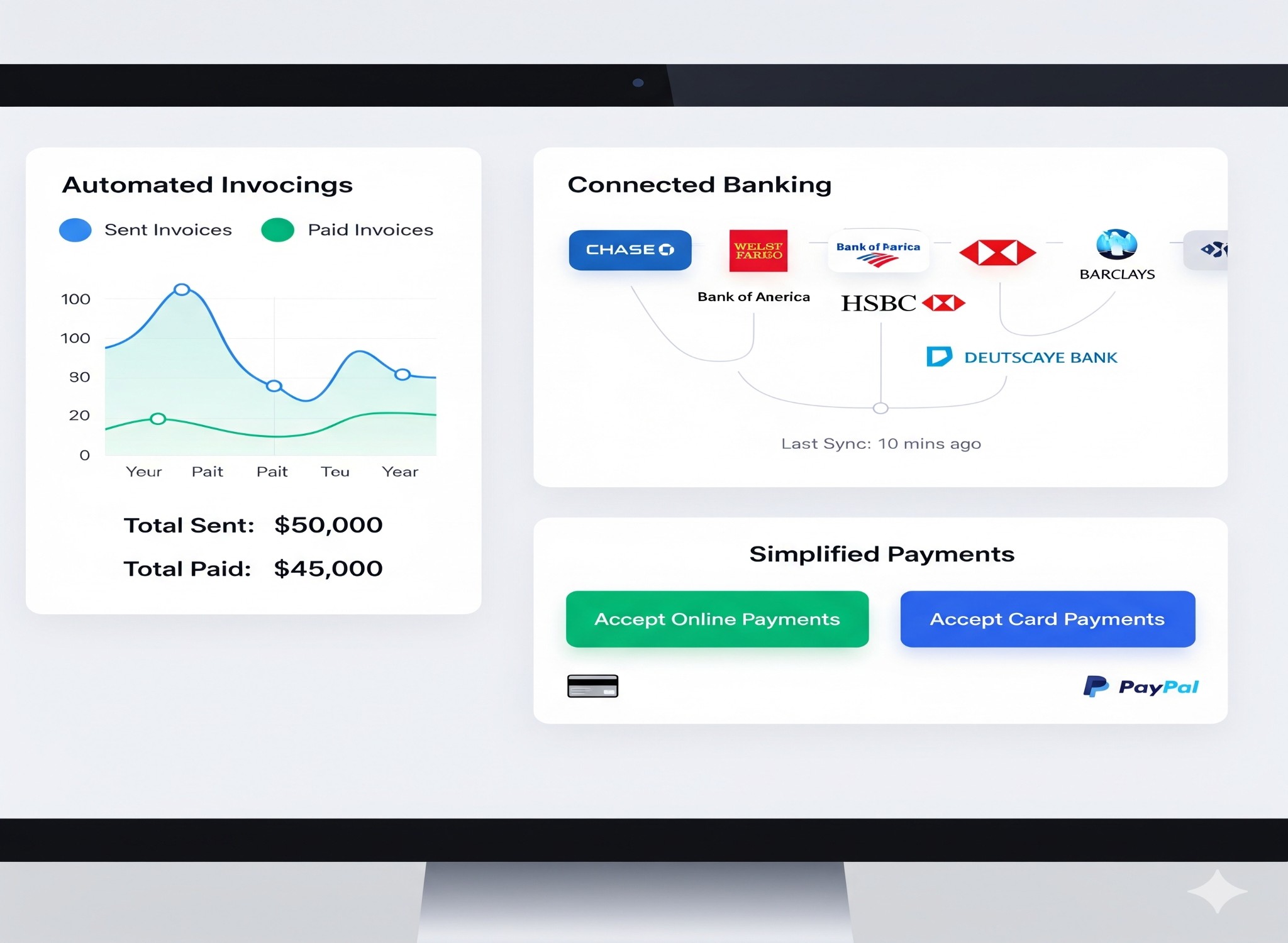

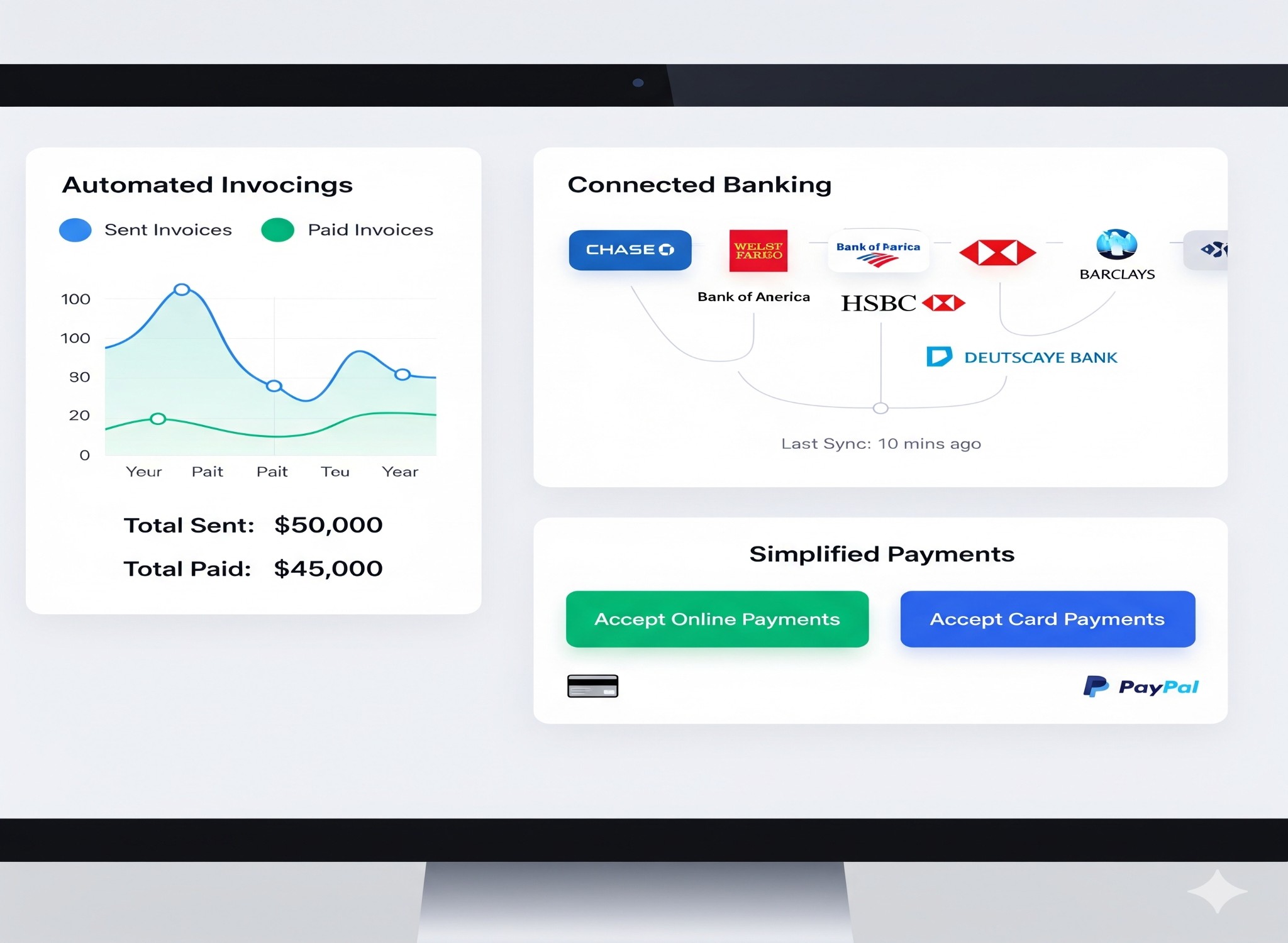

Learn MoreCreate professional invoices, send automated payment reminders, and get paid faster with multiple payment options for your customers.

Learn MoreIntegrate directly with your bank accounts for real-time transaction visibility, automated reconciliation, and streamlined financial operations.

Learn MoreGain valuable insights into your business finances with easy-to-understand reports and dashboards that help you make informed decisions.

Learn MoreWhy small businesses choose CredVue Pay

Automate repetitive financial tasks and free up time to focus on growing your business.

Eliminate the need for multiple financial tools with our all-in-one solution at an affordable price.

Get paid faster and manage outgoing payments more efficiently to optimize your cash flow.

Reduce manual errors with automated calculations and data entry for all financial transactions.

Stay compliant with tax regulations and financial reporting requirements with built-in compliance features.

Our solutions grow with your business, adapting to your changing needs as you expand.

Tools designed with your specific needs in mind

Create customized, professional invoices with your branding and send them directly to customers.

Offer customers various payment methods including credit cards, UPI, net banking, and more.

Automatically match payments with invoices and bank transactions to keep your books accurate.

Generate comprehensive financial reports including cash flow, profit & loss, and balance sheets.

Manage GST calculations, generate GST-compliant invoices, and prepare for GST returns filing.

Manage your finances on the go with our mobile-friendly platform accessible from any device.

Success stories from businesses like yours

"As a small retail business owner, managing finances was always a challenge. CredVue has simplified our invoicing and payment processes, saving us hours each week and improving our cash flow significantly."

Owner, Boutique Fashions

"The connected banking feature has been a game-changer for our service business. We now have real-time visibility into our finances and can make better decisions based on accurate data."

Founder, Tech Solutions

"As a growing e-commerce business, we needed a solution that could scale with us. CredVue has provided exactly that, with features that adapt to our changing needs and excellent customer support."

CEO, Online Essentials

Choose the plan that fits your business needs

per month

per month

Need a custom plan for your business? Contact us for a personalized solution.

Answers to common questions from small business owners

Join thousands of small businesses that trust CredVue for their financial operations.