Financial Solutions for SMEs

Streamline your business finances, improve cash flow, and drive growth with CredVue's comprehensive financial management solutions for small and medium enterprises.

Streamline your business finances, improve cash flow, and drive growth with CredVue's comprehensive financial management solutions for small and medium enterprises.

Common obstacles that small and medium enterprises face in financial management

Balancing accounts receivable and payable while maintaining sufficient working capital for operations and growth.

Gaining real-time insights into financial performance to make informed business decisions quickly.

Creating, sending, and tracking invoices efficiently while managing late payments and collections.

Staying compliant with complex tax regulations and ensuring accurate financial reporting.

Managing financial operations with limited staff and expertise while focusing on core business activities.

Securing financing for business expansion, equipment purchases, or managing seasonal fluctuations.

Tailored financial tools to help your business thrive

Get a clear picture of your business's financial health with our intuitive dashboard designed specifically for SME owners and finance teams.

Predict future cash positions with accurate forecasting tools that help you plan for upcoming expenses and investments.

Track profit margins by product, service, customer, or department to identify your most profitable business areas.

Access up-to-date financial statements and key performance indicators whenever you need them.

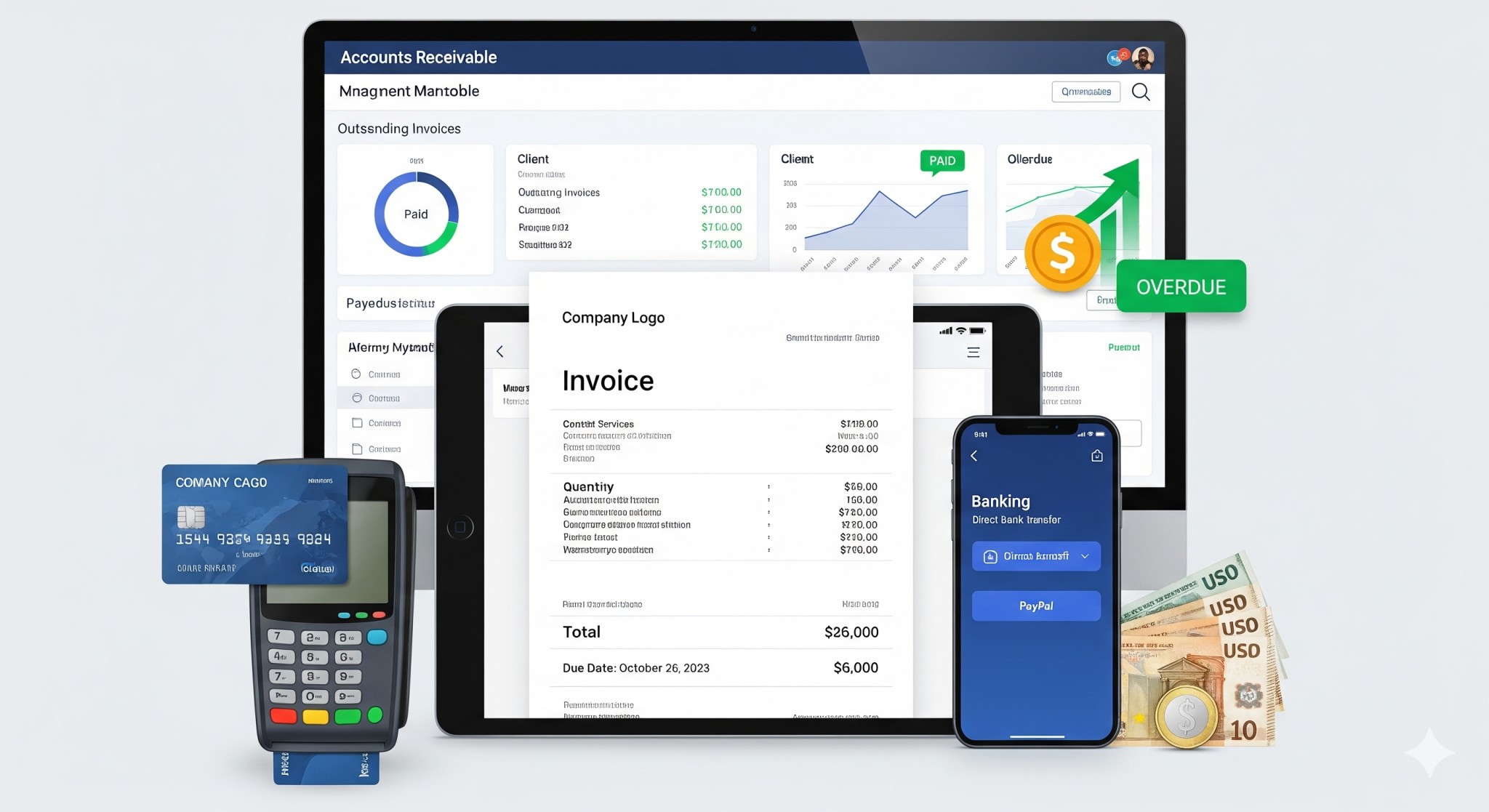

Streamline your invoicing process and get paid faster with our comprehensive invoicing and payment solutions.

Create and send branded invoices with just a few clicks, including automatic payment reminders and tracking.

Offer customers various payment methods including credit cards, bank transfers, and digital wallets to improve collection rates.

Track outstanding invoices, aging reports, and customer payment history to manage collections effectively.

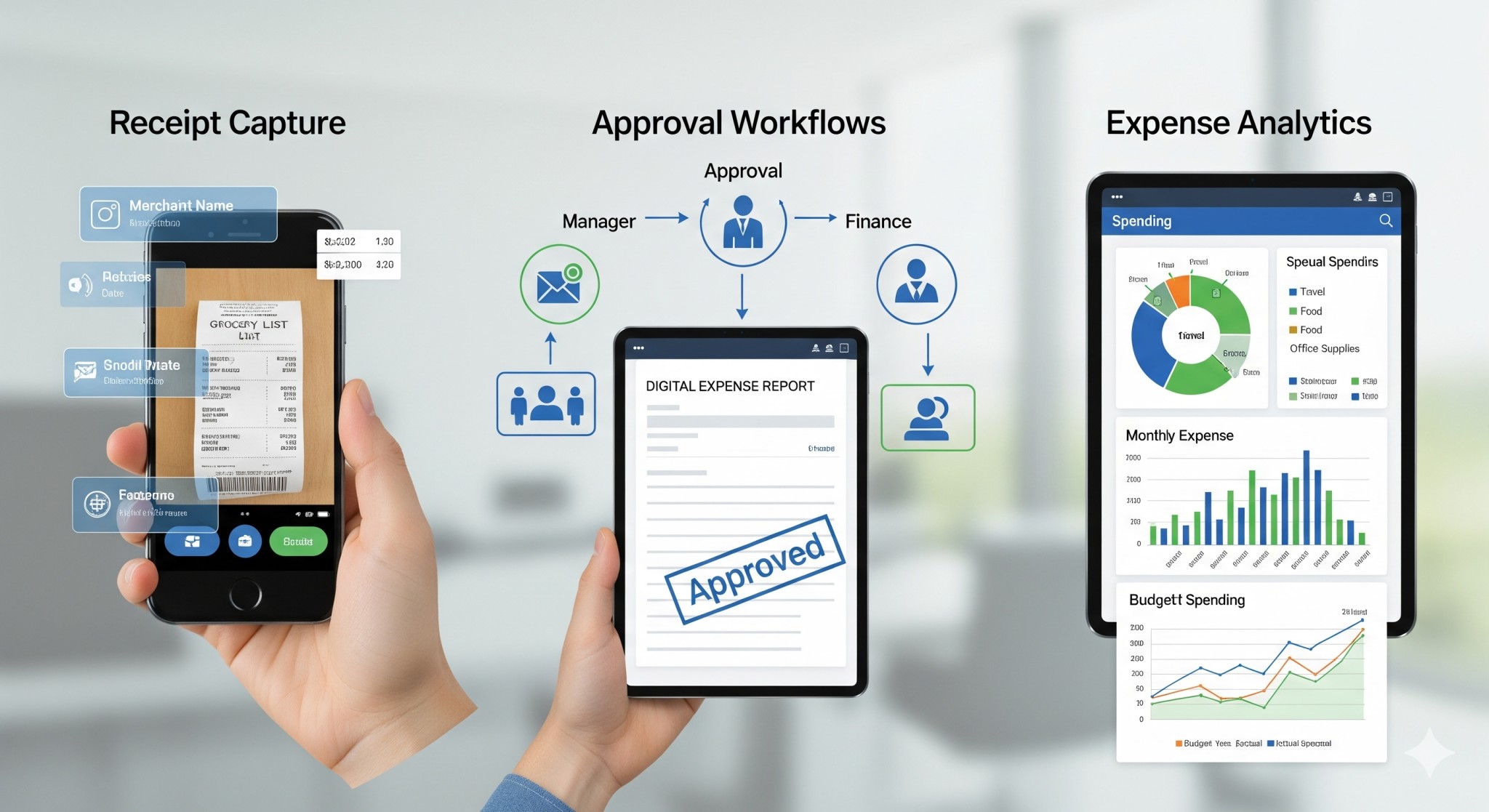

Take control of your business expenses with automated tracking, approval workflows, and detailed reporting.

Snap photos of receipts with our mobile app for instant digitization and categorization of expenses.

Set up custom approval processes for different expense types and amounts to maintain proper controls.

Identify spending patterns and opportunities for cost savings with detailed expense reports and analytics.

Seamlessly connect your bank accounts for real-time financial management

Automatically match transactions with your accounting records to ensure accuracy without manual effort. Our smart matching algorithms reduce errors and save hours of work each month.

Connect and manage multiple bank accounts in one place for a consolidated view of your business finances. Monitor balances, track transactions, and transfer funds between accounts seamlessly.

Affordable plans that scale with your business

For small businesses

per month

For growing businesses

per month

For established businesses

per month

Need a custom solution? Contact our sales team

See what our customers are saying about CredVue

"CredVue has transformed how we manage our finances. The automated invoicing and payment reminders have improved our cash flow dramatically, and the financial insights help us make better business decisions."

Owner, Sunrise Manufacturing

"As our business grew, our old accounting system couldn't keep up. CredVue scales with us and provides the detailed reporting we need. The bank integration feature alone saves us hours of manual work each week."

CFO, GreenTech Solutions

"The expense management features have been a game-changer for our team. No more lost receipts or delayed reimbursements. Everything is digital, organized, and our approval workflows ensure proper controls."

Director, Horizon Retail

Common questions from SME owners

CredVue offers seamless integration with popular business tools including accounting software, CRM systems, e-commerce platforms, and payment gateways. Our API also allows for custom integrations with your proprietary systems.

Absolutely. We implement bank-level security measures including 256-bit encryption, two-factor authentication, and regular security audits. Your data is stored in secure, SOC 2 compliant data centers with continuous monitoring.

Yes, our Professional and Enterprise plans include custom reporting capabilities. You can create tailored reports with the exact metrics and KPIs that matter to your business, save report templates, and schedule automated report delivery.

Most SMEs are up and running with CredVue within 1-2 weeks. Our onboarding team will guide you through the setup process, including data migration, user training, and system configuration to match your business workflows.

Join thousands of SMEs using CredVue to streamline financial management and drive growth.